A MAP OF YOUR OPTIONS FOR MEDICARE COVERAGE¹

Thad R. Harshbarger, PhD. ²

1-22-2023

If you are currently eligible for Medicare health insurance coverage, because of your age or one of the disabilities or diseases it covers, then you need clear directions for deciding what to do about making use of it.

In order to make use of your Medicare benefits, it is important that you make several decisions in the right order. They are not difficult decisions, and the information about making them seems clear and simple. One problem is that so much information is presented and in such a mixed-up order that it quickly gets confusing. After a while, you may be tempted to give up and run away.

Another problem is that Medicare Advantage plans are being presented so vigorously by insurance companies that they may seem like the only reasonable choice.

The purpose of this presentation is to put your choices about medical insurance in a clear sequence, so you can sort them out effectively. Then when you go to more comprehensive resources, they won’t be so confusing.

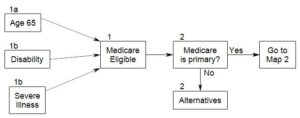

The overall discussion is divided into three maps that must be considered in order. The choices you make in each map reduce the number of issues that you have to look at in later maps. It’s like a road map of upstate New York: if your destination is in Columbia County, once you get there you don’t need the map for Ulster County any more. However, it’s still a good idea to chart out your entire path before taking action. It may be that a later choice will lead you to re-consider an earlier one.

Each of the maps consists of a flow chart that organizes the issues so you can address them easily and in an appropriate sequence. Boxes on the flow charts are keyed to sections of text that describe them more completely.

Here is the overall layout of this presentation:

Map 1 asks two questions to get you started:

1. First, are you eligible for Medicare, or will you be eligible soon?

2. Then, if you are eligible, is Medicare your only option, or are you participating in an alternative plan that takes priority?

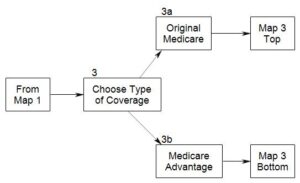

Map 2 discusses type of coverage, once you have enrolled in Medicare. There are two options:

- Original Medicare

- Medicare Advantage Plan

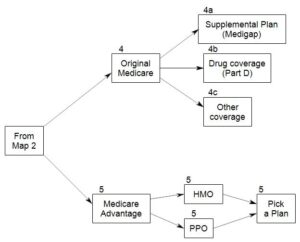

Map 3 has two parts. You look at one or the other, depending on your choice in Map 2:

- The top part considers additional coverage that you might need if you have chosen Original Medicare.

- The bottom talks about choices among Medicare Advantage Plans.

MAP 1: THE FIRST TWO DECISIONS TO MAKE:

ARE YOU ELIGIBLE FOR MEDICARE, AND DO YOU WANT IT?

SECTION 1. ARE YOU ELIGIBLE FOR MEDICARE?

There are three ways that you can be Medicare eligible. If you are eligible, then it pays you to decide whether you want to choose the coverage it provides (Section 2)

1a. You can be age 65 (almost) or older

1b. You can have a serious disability that is among the disabilities that Medicare covers

Or you can have a severe illness that is among the illnesses that Medicare covers

1a. You are Old Enough

You become eligible for Medicare coverage on your 65th birthday. However, it matters when you apply for coverage.

You can make an initial application during a seven-month period: the month of your birthday, the three months before, and the three months after. If you were born May 3rd or 10th or 21st, it’s all the same to Medicare: May is your birth month. Then if your birth month is May, you need to enroll between the first of February and the end of August. (There is an exception for the first day of each month – see a Medicare counselor.) To learn more about the initial enrollment period, click here.

If you fail to enroll during your seven-month enrollment period, you can still enroll, but a penalty will be added to your premium, and it could continue forever. To learn more about penalties, click here.

1b. You Are Disabled or You Have a Severe Illness

Certain disabilities and illnesses qualify you for Medicare coverage regardless of your age. Because the list is long, you should consult with your primary care physician or other medical providers about your eligibility. They may also be able to help you enroll or refer you to someone who can.

ENROLLMENT EXCEPTIONS

There are very few exceptions, and they are very specific. Don’t assume that you have one; contact a Medicare counselor or research your issue on medicare.gov.

SECTION 2. SHOULD YOU ENROLL IN MEDICARE OR DO YOU HAVE AN ALTERNATIVE THAT IS YOUR PRIMARY INSURANCE?

The whole point of medical insurance is to reduce the risk that some expensive medical emergency will wipe out your savings and other assets. Most people need to enroll with Medicare as their primary insurance, but there are other options. If you think that you have other insurance that is primary, be sure to research it on medicare.gov or with your insurance provider, or check with a Medicare counselor.

2a. What Are Your Choices?

MEDICARE

Medicare coverage is divided into four parts, A, B, C, and D.

1. Part A is for hospitalization

2. Part B is for professional services

3. Part C is for Medicare Advantage plans (see Map 2)

4. Part D is for drug coverage

Original Medicare includes Parts A and B, with Part D as an add-on option.

Part C is not something additional; it is reserved for Medicare Advantage Plans. Those plans include combinations of Parts A, B and D. This distinction will be discussed in Map 2.

INSURANCE THROUGH EMPLOYMENT

If you are still employed after the age of 65 or employed with a serious disability or disease, and your company insurance is managing your health needs, you may be able to continue with that. If you do and it terminates at some point, then consult with a human resources person about Medicare enrollment before it terminates.

If you are retired and your retirement insurance is adequate for your expected needs, you may continue with that insurance. However, you will still have to enroll with Medicare.

As an example, TriCare is available to former members of the United States Military.

NO INSURANCE

There are a variety of reasons that people remain uninsured.

- You may think that you are so healthy that you don’t need insurance

- You may not trust the government

- You may think that you can’t afford it

However, there are likely to be consequences of your choice.

- If you ever get sick, doctor visits, medications and lab work can be very expensive, and you will have to pay out-of-pocket for them.

- If you ever end up in a hospital, the hospital may enroll you in Part A or require other insurance as a condition of treating you.

- If you enroll for Part B later on, there will be penalties for coverage.

- There are also limited times during which you will be able to enroll, and delays for coverage to go into effect after you enroll. During those delays, you will be personally responsible for any doctor visits, medication and lab work.

2b. How Do You Choose?

INSURANCE

All insurance is based on the idea of distributing large and unexpected expenses. Medical insurance reduces your immediate cost of medical expenses by paying out of an accumulated fund. You, your employer, and the Federal government have contributed to the Medicare fund in the past, so the money is available. You have contributed to private insurance through monthly premiums.

Your current contributions are in the form of ongoing premiums and deductibles that you pay to the insurance company. The fund may be managed by your employer, in the case of company insurance, or the Federal government, in the case of Medicare.

DIRECT COSTS TO YOU

Whatever kind of insurance you have, you have ongoing costs of premiums that you pay to participate in the insurance pool. This is usually in the form of monthly payments.

Medicare also receives funding through legislation and appropriation.

Whenever you use your insurance coverage to pay for equipment and services, the insurance actually pays for part of the costs. The balance is covered in several ways, by:

- Your copayment. To learn more about copayments, click here.

- Your annual deductible. To learn more about Medicare deductibles, click here.

- Reduced fees charged by hospitals and professionals in order to be paid by your plan.

INDIRECT COSTS

Nothing Is free, certainly not insurance. Private insurance is supported by payments from your company or agency, and those costs are probably reflected in your salary. Medicare is supported in part by funding from the Federal government, which you pay for in taxes. Chances are that you have been paying into the Medicare fund all your working life, along with your income taxes (see https://www.medicare.gov/about-us/how-is-medicare-funded)

COVERAGE

Although there is considerable overlap, different insurance plans pay for different kinds of emergencies, and differing amounts for the same emergencies. In general, the better the coverage, the higher the premium.

MAP 2: CHOOSING YOUR TYPE OF MEDICARE COVERAGE

Once you have decided to enroll in Medicare, you need to decide whether to use Original Medicare or a Medicare Advantage plan.

SECTION 3: TYPE OF COVERAGE IN MEDICARE

Here you have a choice of either Original Medicare or a Medicare Advantage plan. Let’s look at each separately and then consider the choice.

Medicare coverage is divided into four parts: A, B, C, and D. It’s tricky, though, because the parts are very different from one another.

PART A includes costs related to being in a hospital or skilled nursing home. It can also pay for hospice or home health care. To learn more about Part A, click here.

PART B includes:

- payments to physicians, psychologists, and other health care professionals (inpatient and outpatient)

- home health care

- medical equipment

- vaccinations and other preventive services

To learn more about Part B, click here.

PART D pays some of the costs of prescription medications. Private insurance companies offer the plans, under regulations set by Medicare. To learn more about Part D, click here.

3a: Original Medicare

- Original Medicare covers Parts A and B, with separate costs for each.

- If you were employed and paying in to Medicare for ten years or more (roughly) then Part A may be free. If not, you may be able to buy in to it.

- You pay monthly for Part B coverage – currently a little over $170 a month (or more, depending on your income or if you enrolled late).

- For an extra cost, you can get Plan D coverage, to help pay for medication expenses.

3b: Medicare Advantage Plans (Part C)

A Medicare Advantage Plan typically will cover a much greater range of services than Original Medicare, including Part D (medication), hearing, dental and vision. Insurance companies promote this aspect of their coverage. In this respect, it appears to offer much greater value for your healthcare dollar. You don’t need to pay additional premiums for supplemental coverage, because it is likely to be included in your Medicare Advantage Plan.

However, Medicare Advantage Plans are managed care plans. That means that not all Medicare providers are reimbursable, and if you need a professional or facility that is not participating in your plan, you will probably have to pay for it yourself. This can be very expensive.

Three possibilities are particularly concerning:

- You may at some time want to use a professional who participates in Original Medicare but not in your Medicare Advantage Plan.

- You may at some time have medical needs when you are outside the physical area covered by your advantage plan – for example, when traveling on vacation or to visit relatives or friends.

3c: Making the Choice

You should be aware that different plans cover different kinds of medical expenses, and make your choices based on the kind of coverage you are likely to need and the cost of getting it.

Original Medicare is good…

- if you are traveling away from your home for periods of time

- if you have multiple residences or visit friends and family or vacation

- if you use providers that don’t participate in the Medicare advantage plan that you want and you don’t want to switch providers

Medicare advantage plans…

- can be cheaper if you are staying in place and you are willing to use providers who participate in the plan you choose.

- may include Part D and other medical services such as dental coverage and vision coverage.

- may leave you without coverage for some medical procedures or if you are away from the geographic region where the plans operate.

- may limit the medical services that are covered in-net. If you want to use out-of-network services, you will have to pay more of their fees.

You can begin thinking about these issues by:

- Deciding which of your current providers are especially important to you and asking what advantage plans they participate in

- Looking forward to any near-term travel or moving plans and finding out whether you will have medical coverage in other locations – different parts of this country or other countries.

- Exploring the kinds of vision, dental and other part D coverage they provide. To learn more about your choices, click here.

MAP 3: ADDITIONAL CHOICES

What you do next depends on whether you have decided to go with Original Medicare or a Medicare Advantage plan.

SECTION 4: SUPPLEMENTING ORIGINAL MEDICARE

If you have chosen Original Medicare, you must decide whether it is adequate for your needs, or whether you want to supplement it in some way. There are different kinds of supplemental policies for Original Medicare. They include Medigap policies (see 4a below), drug coverage (4b) and other coverage (4c).

4a. Medigap

When you need hospital care or professional consultations, Original Medicare will pay for part or most of the costs. But often not all of them. A Medigap policy pays for another large part of your medical expenses. This can include such things as:

- Annual deductible expenses

- Copayments on services

- Hospice care

- Blood transfusions

- Skilled nursing care

There are ten different Medigap policy types that differ in the coverage they offer. They are provided by private insurance companies, but the coverage is specified by Medicare.

Your job is to:

- Pick the kind of coverage you think you will need.

- Select a company that offers that coverage in your state (usually by cost). Medicare provides clear directions for doing this. Go to Medicare.gov.

- Then at the bottom of the site menu on the home page, look for “Supplements and other insurance” in the left-hand column.

- When you get there, go down to “Find a Medigap Policy”.

- That takes you to a page with clear directions for picking the type of policy and choosing a particular insurance company in your area that offers the coverage you want.

Along the way, you may find a lot of other useful information to look at.

Medicare provides information on selecting a Medigap policy at

https://www.medicare.gov/medigap-supplemental-insurance-plans

4b Drug Coverage

Medicare drug plans are optional because some people have private drug coverage from other resources. So you should begin by checking to see whether you have coverage already. You should verify that this is considered creditable coverage under Medicare.

If you don’t have drug coverage from some other resource, you can get it through Medicare.

There are many options. The ones available to you depend on what coverage you want and where you live. Then you choose a plan according to what it offers.

Each plan has:

- An annual cost

- A monthly premium

- An annual deductible

To search:

- Go to Medicare.gov and select health and drug plans from the top bar.

- To continue, type in your zip code and a Plan Type (part D: drug coverage) and follow the links.

- The amount you can save with each plan depends on the medications you use, so you will need to have that information ready, and you may need to compare the costs for several different drug companies to get the best value for your money.

You can also get started at https://www.medicare.gov/plan-compare.

4c Other Coverage

Dental and vision?

SECTION 5: MEDICARE ADVANTAGE PLANS

Medicare Advantage Plans all include Parts A and B coverage. The plan may add to that Part D coverage plus coverage for dental, vision and hearing. It may also include part of the costs of your Part B monthly bill. Costs and details of coverage vary greatly among plans and insurance providers. There are a number of different plans available for the cost of your regular Part B premium.

However, different Advantage plans provide different benefits, and you need to compare plans to choose one that will benefit you best.

An advantage plan is a managed care plan and fits under either an HMO or a PPO structure, so if you are considering one, you should be clear about which kind It is. If you have been covered by an HMO or PPO in the past, your experience may guide you in making a choice here.

If not, it is possible that the many plans and their sales representatives can make a reasonable decision seem difficult and the plans seem unrealistically comprehensive and cheap. Here are some general characteristics of HMOs and PPOs:

Health Maintenance Organizations (HMOs)

- Require you to have a Primary Care Physician (PCP) who provides most of your medical needs and serves as a gatekeeper to other medical services.

- Offer lower Costs – monthly premiums, copayments, maybe deductibles.

- Have a small network of providers, and only cover payment to in-network providers.

- May not pay for services that are out-of-network.

Preferred Provider Organizations (PPOs) generally…

- are more expensive than HMOs.

- have higher deductibles than HMOs. Out-of-network treatment may not count toward your annual deductible.

- allow out-of-network treatment but it is more expensive than in-network care.

- require copayments for all services.

For more basic information about Advantage plans, see

https://www.medicare.gov/health-drug-plans/health-plans/your-health-plan-options

For access to the plan finder on the Medicare.gov website, click here. This lists plans one-at-a-time, once you have entered your zip code and some other basic information.

Note that each listing states whether a plan is an HMO or a PPO, and each listing allows you to link to more details about the plan. There is a link underneath the heading “Doctor Services” that allows you to view the provider network for that specific plan. You can also verify participation with the providers you use.

REFERENCES

- Medicare.gov

- To learn more about Original Medicare, click here

- To learn more about Medicare Advantage Plans, click here

- Medicare and You

- HealthAdvisor.com

COMMENTS AND SUGGESTIONS

Please send your reactions or any suggestions for improving this presentation to:

Thad@ThadHarshbarger.com

DISCLAIMER

The purpose of this paper is to organize and present material about Medicare that is complex and confusing to many people. The author is a psychologist with no special knowledge of Medicare or other medical insurance and no special knowledge of the law as it pertains to these products. Before making any decision about medical insurance, you should refer to Medicare.gov, related publications of the U.S. Department of Health and Human Services, and if necessary, get advice from a Medicare counselor.

NOTES

1. I call it a Treatment Map®– a document that organizes complex text using flow charts in addition to other ways for finding information.

2. This booklet was written with substantial help from Rachel Cole and Steve Vandenburgh of The Healthcare Consortium of Columbia County, N.Y., who provided much of the detailed knowledge on which the booklet is based. They also read drafts and edited the materials as the work progressed.

3. This material appears online at https://thadharshbarger.com/?page_id=189.

4. You may copy and use this material as you see fit, without restriction or fee, so long as you cite this document and its author.